Product Marketing Lead Gavin Dunaway was floored by the evolution of retail media, but challenges ahead gave him flashbacks of digital media’s development

“Is retail media just the next shiny object of digital advertising?” asked Cara Pratt, SVP of Kroger Precision Marketing, in her opening keynote. “No, it’s not a flash in the pan, it’s here to stay—retail media is changing advertising.”

Perhaps because I’ve chugged my fair deal of the commerce/retail media Kool-Aid, I totally believed her. But I think anyone attending the Retail Media Summit by Path to Purchase Institute in Chicago would probably heartily nod as the conference wrapped up on June 30, 2023. (Read all my Twitter threads.) These three days were chock full of evidence retail media was upending physical, digital, and even linear advertising.

As an AdTech veteran (though not a complete in-on-the-ground-floor guy), I found myself flashing back to my early days reporting on digital advertising in the late aughts. I remembered advertisers at conferences complaining that they couldn’t tie their advertising spend to inventory in stores, but at this conference I spoke to company after company that could do just that. Pratt even joked that we should keep a running tally of how many times the term “closed-loop attribution” came up on stage. (I was glad that didn’t turn into a drinking challenge—many a liver would have exploded.)

At the same time, I was reminded of other conversations from earlier AdTech gatherings: challenges with fragmentation and questions of transparency around performance metrics. The excitement around commerce/retail media is tangible, but it’s fast maturing—and we’re likely to see a lot of shakeups in the next few years.

Performance Measurement Transparency

As much as the term “closed-loop attribution” was tossed around, so was the advertiser need for transparency into metrics. This must sound awfully familiar to publishers reading, but the key issue here seems to be standardization in how performance is being measured.

“I feel for brand advertisers because before retail media, they really were just shooting in the dark. But even now, there’s something like 600 retail media networks? It’s a zoo with no standard measurement.” @themathcompany @P2PInstitute #retailmedianetwork

— Gavin Dunaway (he/him) (@MediaTrustGavin) June 28, 2023

“If a brand gets a ROAS number from me, you should be able to compare that with several other RMNs to best decide where to push spend,” said Claire Wyatt, VP of Business Strategy and Marketing Science at Albertsons Media Collective. “We are not going to agree on methodologies for measuring incrementality, but we can agree to a basic level of transparency.”

The point of standardization is simple: make brand investment easier. It was the same with developing OpenRTB to ensure advertisers could easily buy across platforms and exchanges. Right now, brands need an entire team for each RMN, but they should just have a single team for all RMNs. Not only will this facilitate more budget into the retail media space, it will offer advertisers better insight into which RMBs are truly driving business outcomes.

Performance measurement standardization is as basic as “what does worth mean?” When I say CTR does it mean the same thing across retailers? Can I check my CTR across Walmart and @Albertsons and have it mean the same thing? @P2PInstitute #retailmediasummit

— Gavin Dunaway (he/him) (@MediaTrustGavin) June 30, 2023

“There are lots of stats about huge budgets headed to RMNs, but it’s going to stall if we don’t figure out ways to help brands work with us interchangeably,” Wyatt said. “We can’t have too unique experiences.”

While the IAB is working to develop retail media standards, Albertsons has thrown out its own for the industry’s perusal.

Another standardization sticking point is third-party verification. I overheard advertisers complain a few times: “We don’t want the retailers grading their own homework!” But perhaps data transparency and standardized performance metrics can form trust between advertisers and commerce companies, so they can avoid the ire that comes along with reconciling third-party verification.

In-Housing

The conference kicked off in the wake of Kroger’s announcement that it in-housing its self-serve offering, joining the ranks of Walmart Connect, Lowe’s OneRoof, and Home Depot. There were many interesting sessions dedicated the right growth point to in-house and what that actually looks like.

As Bill Michels from Moloco pointed out, most retailers dip their toes in the water by teaming up with some kind of platform in a network arrangement. But at some point they realize the limitations and; even then, the key is working with partners that can bring tools, like operational machine learning (call it AI if you must) that streamlines data analysis and other processes to scale up business.

What is operational machine learning? Autonomous, no engineers tweaking, systems that learn and improve on their own. We see it everywhere: ChatGPT is the biggie at the moment. (Yes, AI is actually machine learning!) @MolocoHQ @P2PInstitute #RetailMediaSummit pic.twitter.com/ZbCgk8flZ1

— Gavin Dunaway (he/him) (@MediaTrustGavin) June 29, 2023

Jason Pratt, GM and CRO of Koddi, said that outsourced tech and managed services add up when it comes to costs—in-housing makes sense on a simple margin level. The typical in-housing move seems to come in year 5 of operation, with Kroger being an exceptional example. He added that it’s strange that retail media is still operating in a network model, but maturity will lead it into SAAS.

The only content that may have been lacking was: when is in-housing not a good idea? As many people on stage and off pointed out, retail media fragmentation is already a problem, and more and more retailers are jump-starting their networks. It’s questionable whether there’s enough demand to prop up so many in-housed offerings—as mentioned in the previous section, brands need standardization to buy across retailers interchangeably, so they can optimize their retail media spends.

Addressing fragmentation: marketers are going to be tapped out if there’s too many options out there. Problem is everyone is setting up their own front doors—need platforms that can buy across all of them. @koddiyak @P2PInstitute #retailmediasummit pic.twitter.com/l74vjgBU89

— Gavin Dunaway (he/him) (@MediaTrustGavin) June 29, 2023

The deja vu kicks up again: it feels similar to brands saying to publishers back in the day: “We want to buy direct on a few big media networks and pubs, but we’re gonna grab the rest of your audiences programmatically.” A similar kind of infrastructure seems to be being built out here, but it’s much more complicated as brands will want to buy on retailer sites and apps, while also use their data to target on third-party media. Is that possible without retailers losing the value of their consumer data? Don’t ask publishers the answer to that question.

At the same time, is there enough niche demand (e.g., highly endemic plays like sports equipment manufacturers) to support more in-housing? It’s not clear at this point.

No Retailer Left Behind!

And what about the “long tail”? Yeah, nobody likes being called long tail and certainly the term has a lot of negative connotations associated with it from the digital publishing world. But there are many small and independent retailers with consumers that brands would love to reach.

That’s where interesting plays like Ideal by Design House come in—they’ve brought the print circular into the digital world with pizazz to spare. Working with tens of thousands of small and independent retailers across the US, the company is able to extend brand reach outside of the major RMNs, both within apps and on various media.

Independent retailers are being left out of the retail media game; in addition, brands are missing out on reach and data. Design House offers a good looking solution to expand reach and monetize. @P2PInstitute #retailmediasummit pic.twitter.com/Xen2YFaNwT

— Gavin Dunaway (he/him) (@MediaTrustGavin) June 29, 2023

Never Lose Perspective

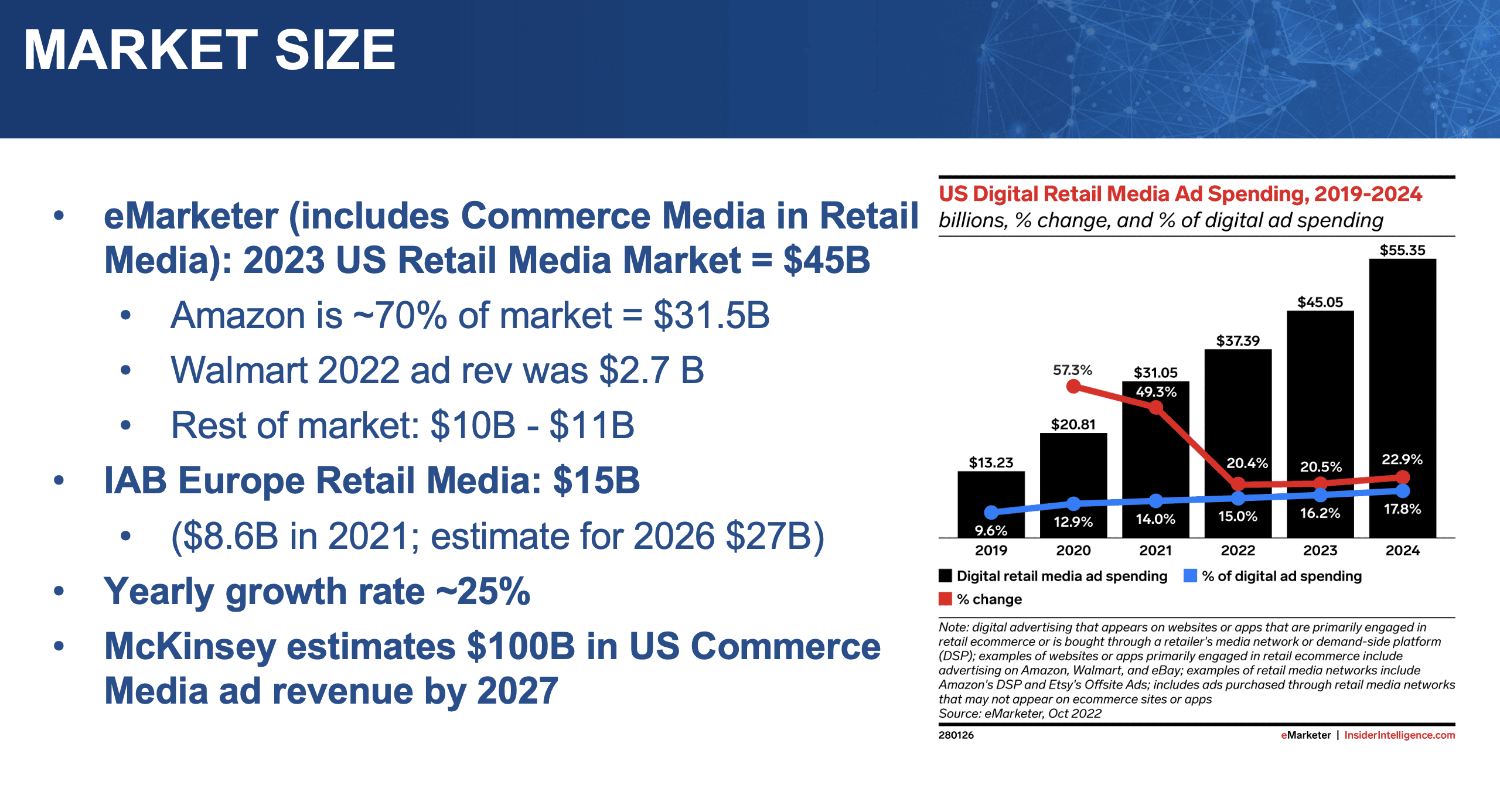

One attendee I shared breakfast with commented, “Be wary of some of the rah-rah cheerleading you hear about retail media’s potential. That eMarketer graph everyone likes to share with $45 billion in spend up for grabs is misleading.”

It sure is, I replied—eMarketer includes Amazon in that market estimate, and Amazon likely has a +70% share of that $45 billion in US revenue in 2023. Walmart Connect is likely grabbing another $3-$3.5 billion in 2023. So more likely the US market is $10-$11 billion.

Retail media’s potential revenue is skewed by the inclusion of Amazon, but even taking out Amazon and next biggest player Walmart, there’s a good chunk of change there.

That might not be $45 billion, but it’s nothing to sneeze at—especially when the market is growing at about 25% YOY and Amazon’s share of that pie is reducing each year. Plus, most likely these retail media dollars are incremental spend from advertisers as well as dollars shifting away from social/walled gardens.

A New (Good?) Ad Network Era

Going back to my early days reporting on digital advertising as RTB ascended (and MediaMath, RIP, was one of many rising stars), I always recall representatives from ad networks (most of which no longer exist) telling me not to pay attention to the DSPs and SSPs. They claimed RTB was a fad that would soon flame out.

That story always gets a good laugh. I doubt anyone is doubting the transformative power of commerce/retail media considering the massive success of Walmart Connect and Kroger Precision Marketing (not to mention the OG retail media network, Amazon). However, we may be reconsidering the role of ad networks.

Mobile Dev Memo’s Eric Seufert likes to comment with every new commerce media play that pops up that “Everything is an ad network!” That term is extremely toxic in digital advertising due to ad networks of yore (yore being 10-20 years ago) with questionable performance metrics, fill consisting of shady and ugly ads (that often contained malware and/or broke sites!), and little to no transparency into inventory on either side of the coin.

But Allison Schiff of AdExchanger asked it at Programmatic I/O in May—with buy-side platforms like The Trade Desk building pipes into publishers (Open Path) and sell-side platforms like Magnite opening up to advertisers (particularly for CTV), are we headed back to Ad Network City?

As I’ve tried to describe how retailers and commerce companies are leveraging their audience data for advertising on third-party sites and apps, the term “intermediary” kept coming to mind. It’s got slightly less baggage than ad network.

Still maybe retailers and commerce companies serving as ad networks with transparency in targeting, data commingling with advertisers, and verifiable performance is not a bad thing. Why? Well, possibly because it’s not retail/commerce’s core business—these companies are not on the endless hunt for margin. Advertising is an incremental revenue stream, but many retailers/commerce companies see it as a way to better meet consumer needs.

There’s never been an ad network like that—it’s an industry sea change.