Product Marketing Lead Gavin Dunaway suggests that the collapse of FTX should make publishers and ad platforms alike contemplate crypto ad policies and potential for consumer harm.

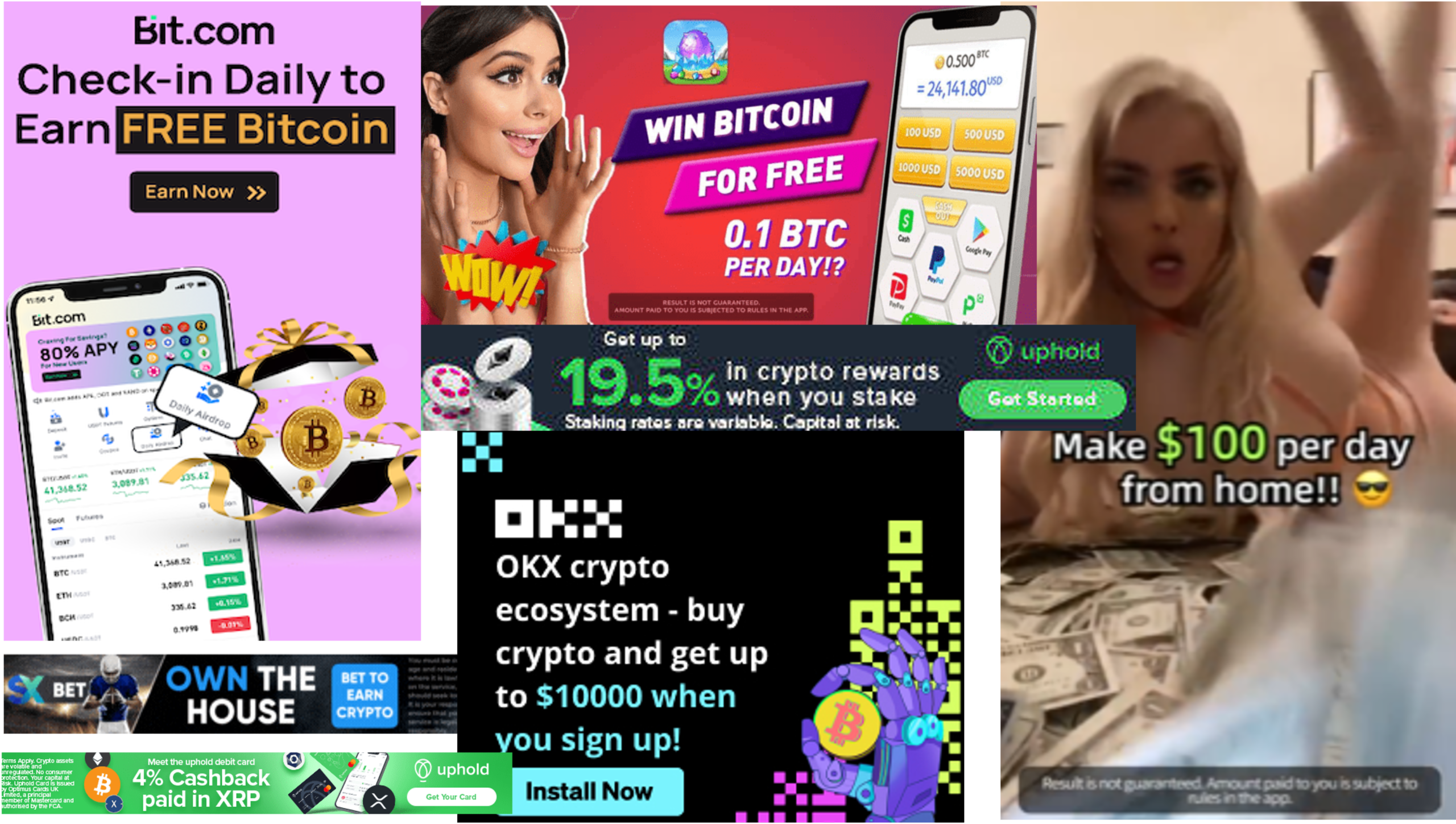

I was generally surprised by the results of an informal poll of revenue operations professionals at the March 2022 AdMonsters Publisher Forum in Clearwater. The Media Trust team put together a postcard full of creatives that could be considered “dicey” (Figure 1)—a hotel ad featuring a lot of flesh, an ad for a cannabis business conference, a political ad where a former police officer held up a sniper rifle, etc. We asked the publishers at the conference which ads they would be OK with running on their properties.

The stat that really took me back was that 55% said an ad for a crypto wallet app called YouHodler was A-OK.

-

Figure 1: 55% of publishers at the AdMonsters PubForum suggested they were fine with most crypto advertising.

I honestly thought more publishers would be wary of embracing crypto advertising, but I had to admit my personal bias. I’ve long been skeptical of cryptocurrencies, seeing them mainly as tools to propagate illicit activities and circumvent regulation.

Diving deep into the piles of creative flagged from DSPs and SSPs by our AI-powered Ad Categorization engine, I realized that cryptocurrency advertising is rampant. Scrolling through ads for dozens upon dozens of coins, exchanges, lending companies, and consultants/advisers, I couldn’t help thinking: how many of these are grifts?

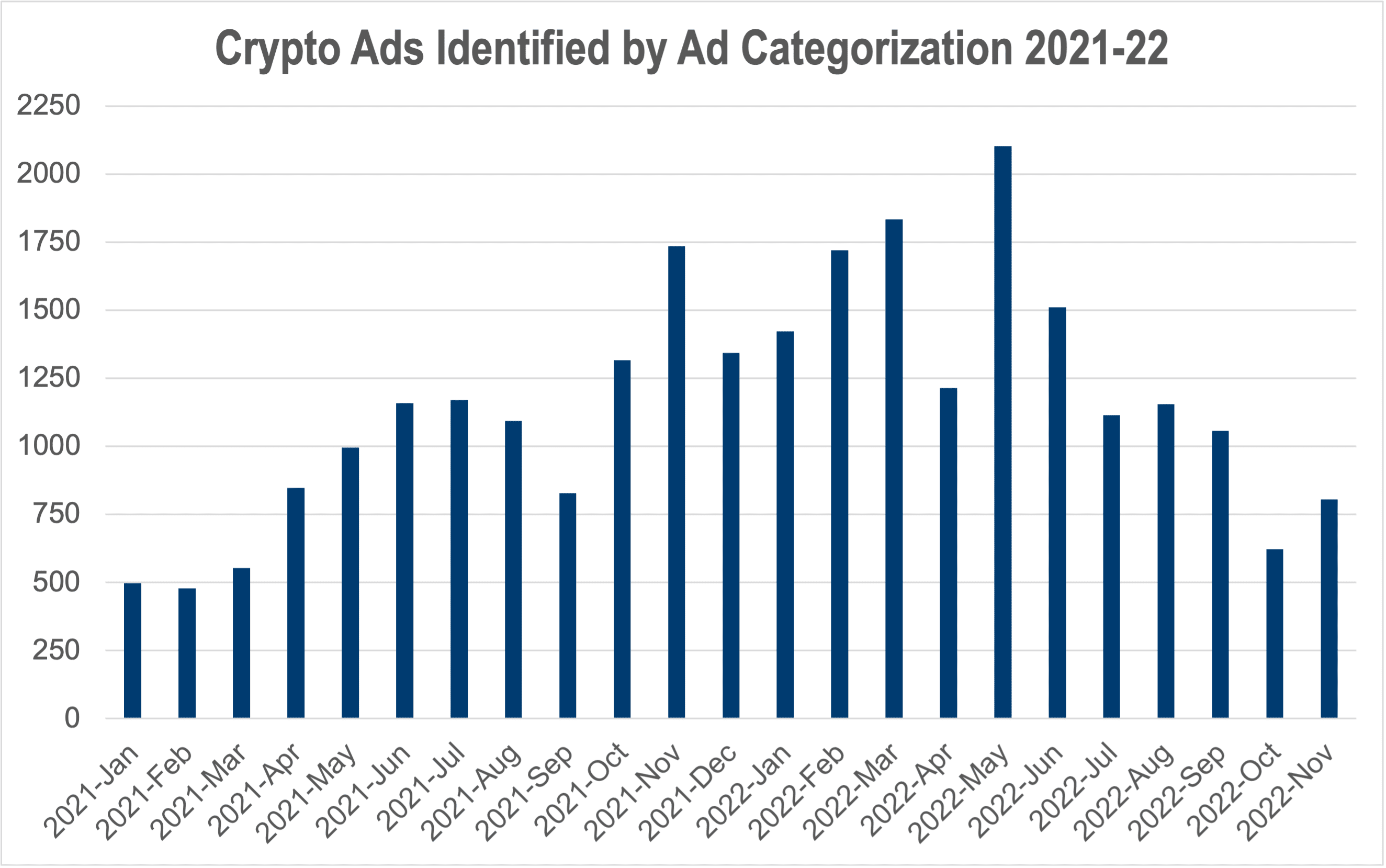

But publishers answered The Media Trust’s poll in the wake of the 2022 Super Bowl, where crypto ads made a monstrous splash, deploying QR codes, Larry David, and Matt Damon’s narration to convince folks that crypto is an on-the-level, high-performing investment opportunity. The number of specific creatives for crypto (which represent billions of impressions) grew ~50% between January and May 2022. (Figure 2)

-

Figure 2: Crypto advertising has been generally on the rise since Jan. 2021, but steeped off considerably after May 2022 when market instability grew.

Clearly, the high volume of ads has benefitted publisher revenue, but at what cost to consumers?

Crypto Winter

Oh what a difference half a year makes. Fourth quarter 2022 is already being labeled “Crypto Winter” following the epic crash of the FTX exchange and BlockFi, which FTX had previously bailed out.

The fall of Sam Bankman-Fried’s empire was only the latest and greatest crypto bust of 2022: TerraUSD, Celsius Network, and Voyager Digital spectacularly flamed out in the last six months. “Stablecoins” like Tether have been rocked by the chaos in the crypto market and regulators are tripping over themselves to bring scrutiny to the space.

And what about consumers themselves? We’re only beginning to see the fallout from FTX alone, with Ontario teacher pensions looted to the tune of $95 million and potentially more than a million creditors in the bankruptcy case.

The last several months have shown crypto is a rickety roller coaster operated in the wildest part of the Wild, Wild West. Named threat FizzCore has long hijacked celebrity images to lure unwitting consumers into crypto scams; it’s questionable whether crypto ads with real celebrity endorsements are much different.

No surprise, the amount of crypto creative in digital advertising has fallen since the May peak—a 62% decline through November (Figure 2).

A Hard No or a Nuanced Policy?

As 2023 edges closer, publishers and ad platforms alike should rethink their policies regarding crypto advertising. Building digital trust and safety with audiences means serving advertising from companies that you can comfortably consider credible—not timebombs waiting to destroy their life’s savings.

Is a heavy-handed block of all crypto ads the solution? For some publishers and platforms, yes, but not those willing to work a bit to weed out the bad actors. Even in the pool of questionable exchanges and services, plenty of well-regarded financial institutions advertise webinars, whitepapers, and other guidance on entering this chaotic market.

Digital advertising practitioners need to show a lot more nuance in what kind of crypto ads are acceptable. Premium platforms exercise this kind of caution, developing detailed policies that prohibit offering free cryptocurrency, gambling with cryptocurrency, etc. (Figure 3)

-

Figure 3: DSPs and SSPs are increasingly prohibiting ads where cryptocurrencies are offered for free, used for gambling, and even are a source of payment for labor.

Publishers can still drive crypto ad revenue and keep clear of shady players by developing similarly nuanced policies. You can execute these through click-to-block galleries of ad creatives, filtered by sensitive subject matter like crypto.

Crypto is different from other ultra-risky financial tools advertised in the past. It’s a barely regulated market with a lot of shadowy characters and mechanisms involved (we didn’t even discuss cryptojacking via malvertising!). The 2022 Super Bowl ads offered publishers and ad platforms alike false confidence in the stability of the crypto market. Now’s the time to rethink what you want your brand associated with, and what kind of advertising you want to serve your precious audiences.